Creating Cousin Connection (“Don’t Let a Funeral Director Plan Your Next Family Reunion”)

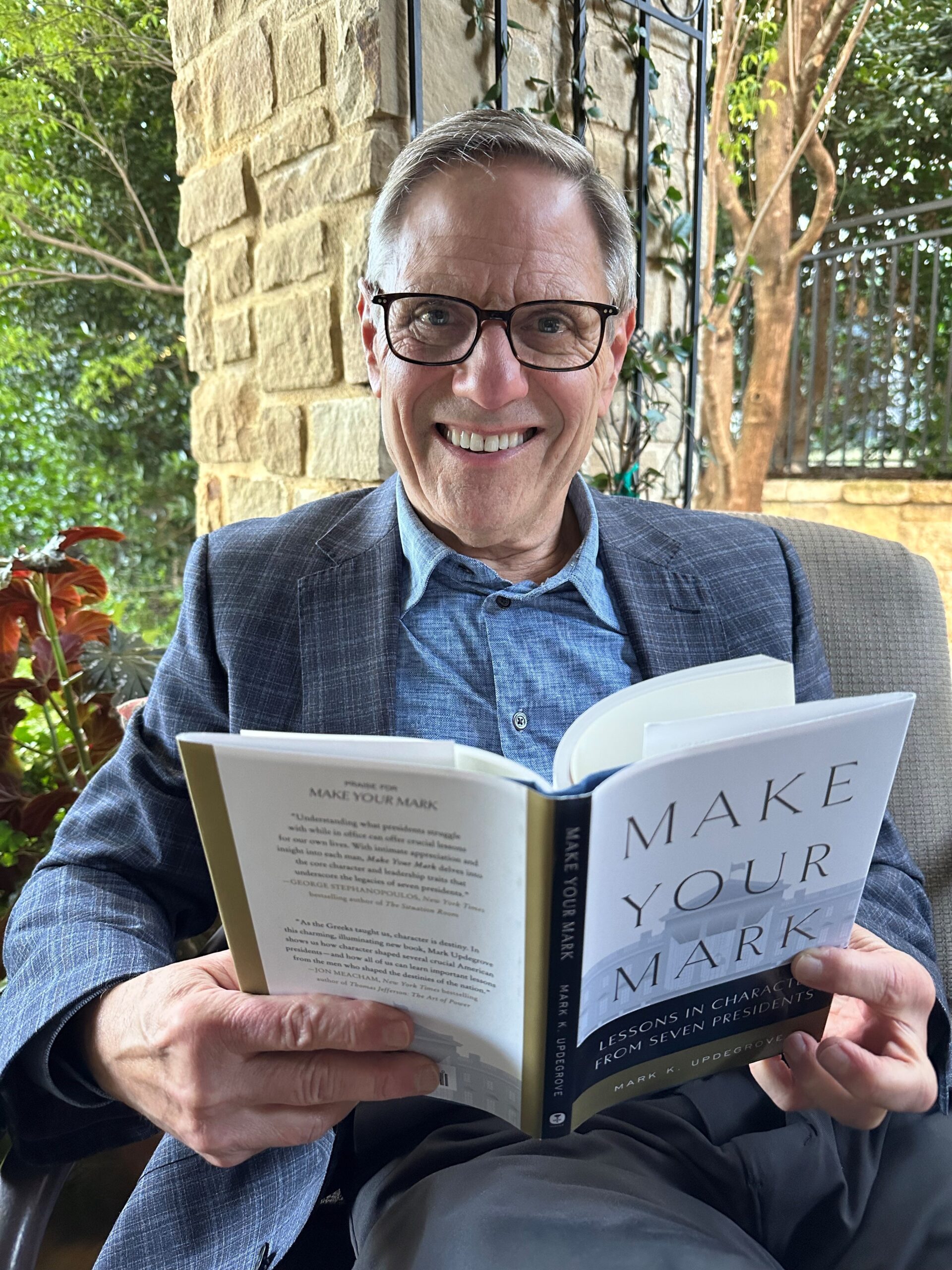

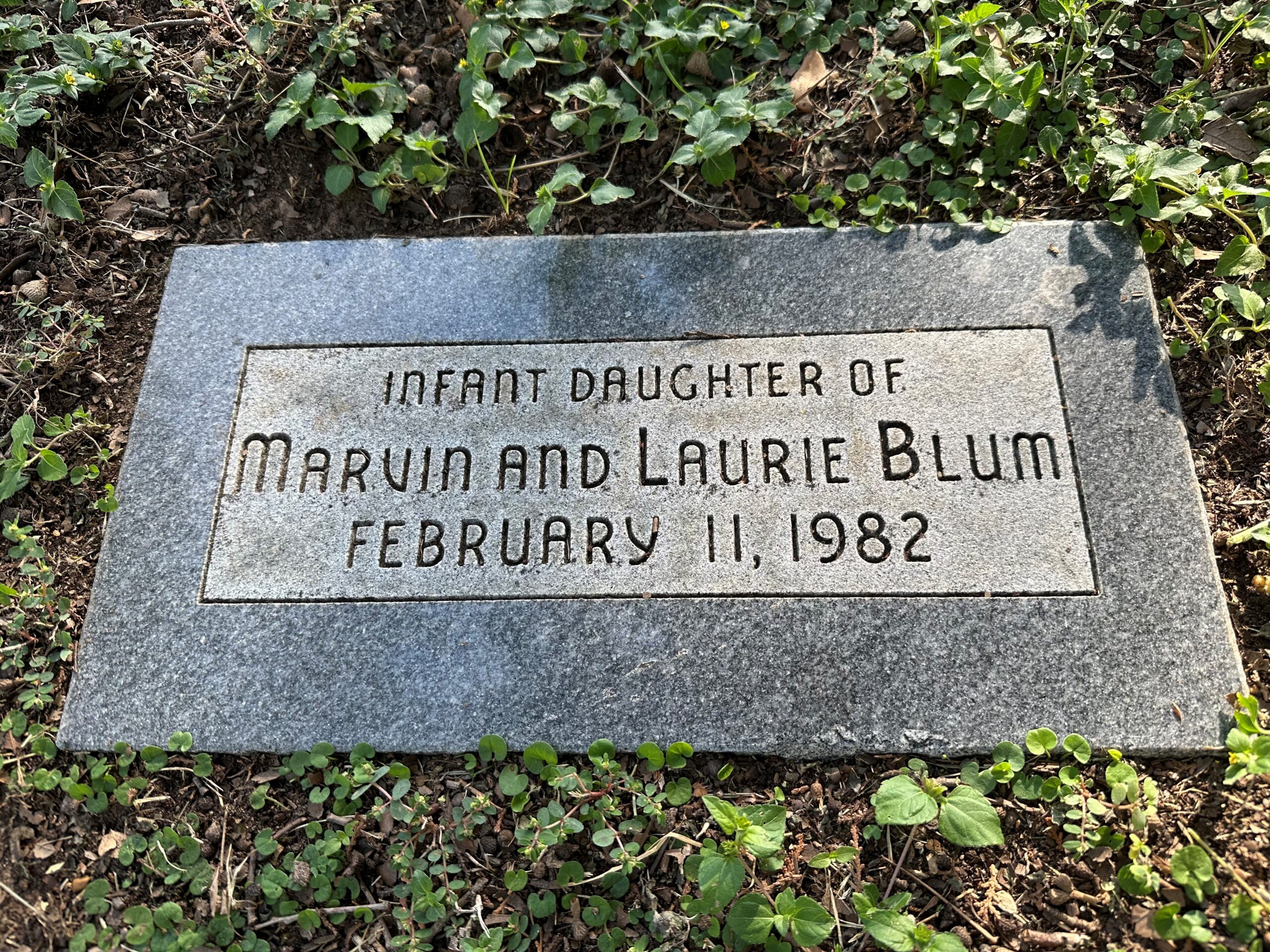

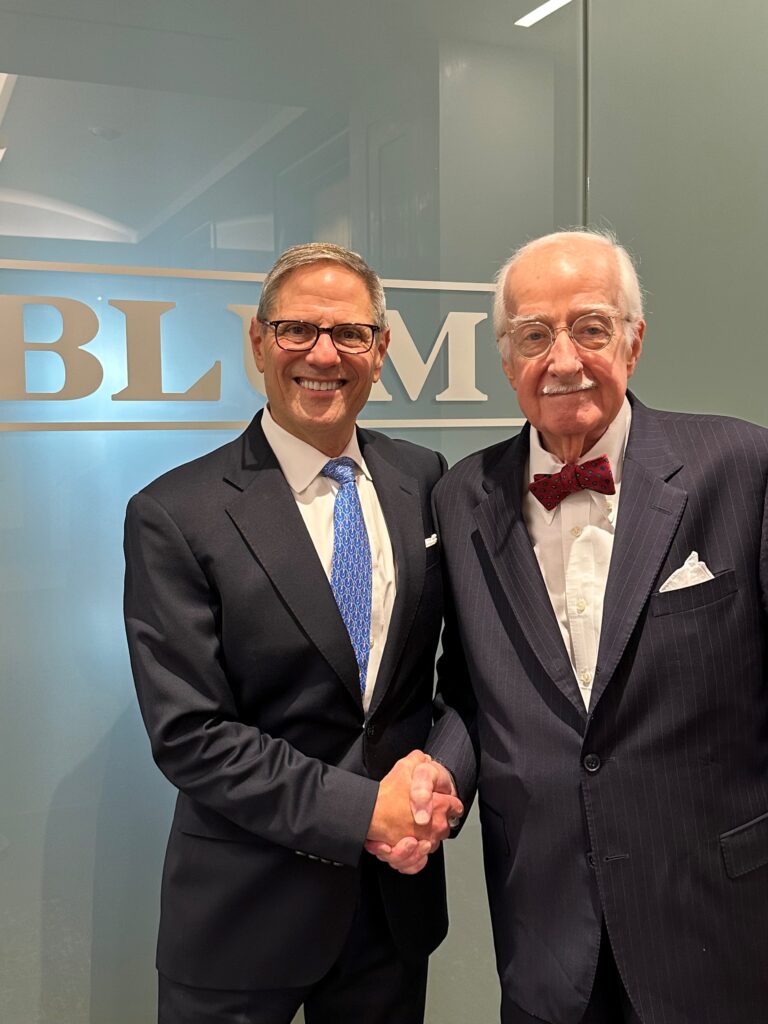

How do you create a lasting family legacy? There’s no perfect formula, but one of the key building blocks is getting the family together to grow a close family connection. You have to be intentional. It doesn’t happen automatically. The breakdown is especially vulnerable when you get down to G3 (the third generation). In the Blum family, I’m deeply committed to helping my six G3’s build a strong bond of cousin love.

The challenge is intensified by the fact that three live in Austin and three live in New York. Plus, they live busy lives with busy schedules. Laurie and I give our all to creating opportunities for the cousins to grow up feeling close to each other, even though they don’t live geographically close.

We have frequent FaceTime chats where everyone joins. But there’s nothing better than in-person time together. The solution to making that happen is obvious—family travel. I’ve been an advocate for family travel for years, even before I had grandkids. I became convinced long ago at a speech by Mitzi Perdue, author of How to Make Your Family Business Last. Perdue’s answer to business longevity shocked me. Perdue, a member of two successful family dynasties (Sheraton Hotels and Perdue Farms), credited her family’s success largely due to family travel. I expected her to tout all kinds of corporate policies and governance structures, but ahead of all that is the critical importance of family travel.

Perdue praised the generations before her with creating trusts that endowed the cost of family travel. Like the FAST* Trust I propose, Perdue’s ancestors established a separate trust dedicated to paying for family enrichment activities. A portion of the inheritance is set aside in a separate fund to cover the cost of bringing the family together.

Over the last couple of months, Laurie and I gathered all the grandkids twice. We first brought them all to Fort Worth to bunk in our house for a week, including numerous valuable visits with my mother Elsie, their great grandmother. A few weeks later, we splurged on a family trip to Disney World. Watching their close and loving interactions convinced me that our travel investments will pay big dividends.

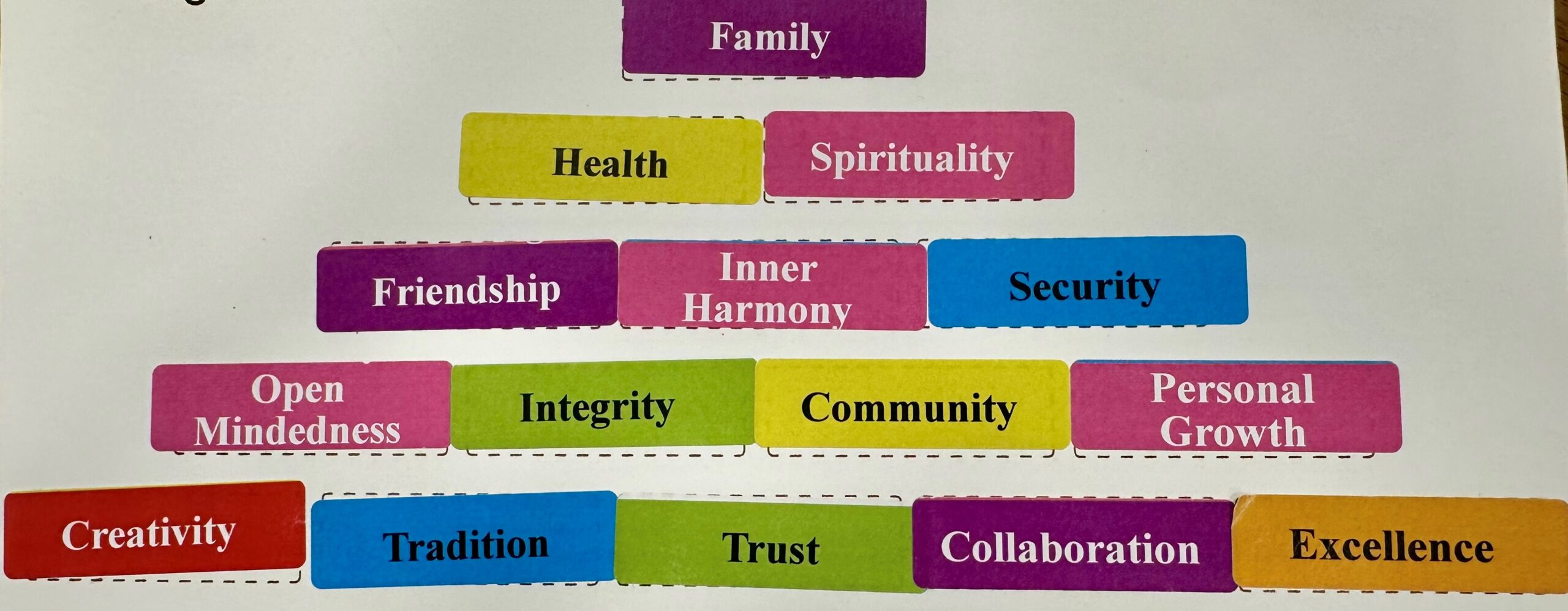

My commitment to fostering that cousin love was affirmed in the January 2026 “Family Business Minute” blog post by Jeff Savlov entitled “Cousin Vibes.” Click on this link to read Savlov’s compelling case for cousin connection. Savlov acknowledges that the greatest risk to family continuity occurs at G3, per the proverb “shirtsleeves to shirtsleeves in three generations.” It’s the third generation that most often squanders not only the family’s valuables, but also the family legacy values. To counteract the risk and build a stewardship mindset, you need to “put effort into getting the cousin’s together…. When there is a family culture of intention, purpose, and strong values, G-3 becomes infused with it and the cousins have a special bond that strengthens the foundation set by the generations before them.”

Savlov and I are perfectly aligned. As he so eloquently concludes, “nurturing the cousin generation” leads to “humans of motivation, character, family connection and love.” I saw it happen with my own eyes as my New Yorker’s Stella, Juliet, and Ollie bonded so tightly with their Austin cousins Lucy, Grey, and Mia.

As if I needed more motivation to champion the cause for family travel, Mitzi Purdue ended her talk with a zinger. She lamented that over time, families start to just see each other at Thanksgiving, then less and less, to the point it’s only at funerals. Purdue’s final admonition, “Don’t let a funeral director plan your next family reunion.” That got my attention.

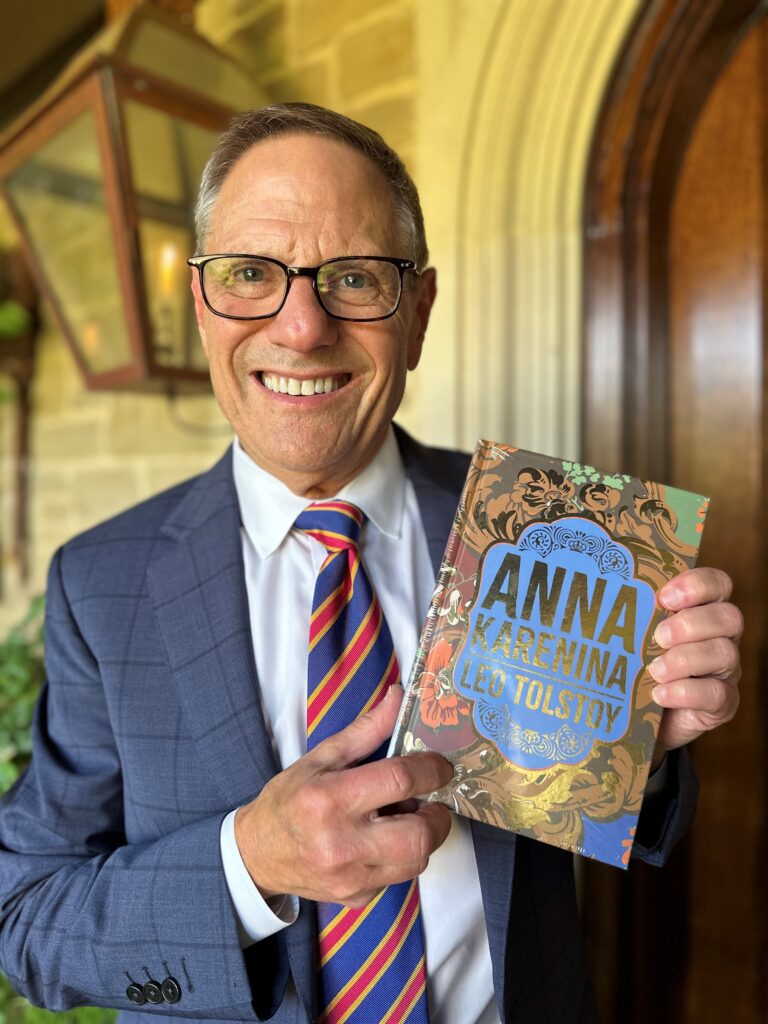

Marvin E. Blum

*The FAST Trust is a Family Advancement Sustainability Trust. Rather than providing distributions for HEMS (health, education, maintenance, support), distributions pay for activities like family meetings, retreats, travel, education, and building connection.

Gathering Marvin Blum’s six grandkids with their great grandmother Elsie Blum pays multiple dividends. Not only does it foster cousin love, it also helps pass down Elsie’s legacy as the family matriarch.

Marvin and Laurie Blum take intentional steps to connect the three New York grandkids with their three Austin cousins.

Family travel is critical to building a family legacy, endorsed here by Marvin and Laurie Blum on a Disney World getaway with their kids and grandkids.